Bitcoin OGs are now selling more slowly, with markets now weighing the implications of this move for the BTC price.

Source: utoday | Published: Jan 15, 2026Litecoin (LTC) was also an underperformer, down 2.1% from Wednesday.

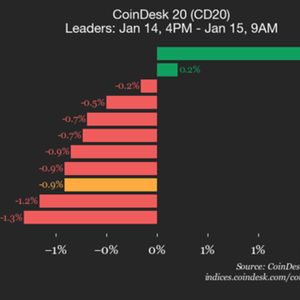

Source: coindesk | Published: Jan 15, 2026

Toobit, the award-winning global cryptocurrency exchange, today announces the launch of its Elite Championship, a

Source: ambcrypto | Published: Jan 15, 2026BitcoinWorld Ethereum Foundation and Undefined Labs Launch Transformative Education Initiative for South Korean Financial Sector SEOUL, South Korea – April 2025 – In a significant development for Asia’s financial technology landscape, blockchain research firm Undefined Labs and the Ethereum Foundation Enterprise Team have announced a groundbreaking partnership to educate South Korea’s financial sector about Ethereum technology. This collaboration represents a strategic move to bridge the knowledge gap between traditional finance and decentralized systems, potentially accelerating institutional adoption across one of Asia’s most technologically advanced economies. Ethereum Foundation and Undefined Labs Forge Strategic Alliance The partnership between Undefined Labs and the Ethereum Foundation Enterprise Team marks a pivotal moment for blockchain education in institutional finance. Undefined Labs, established in 2018, has built a strong reputation as South Korea’s premier blockchain research and education organization. The firm has previously collaborated with major domestic universities and financial institutions to develop comprehensive blockchain curricula....

Source: bitcoinworld | Published: Jan 15, 2026

Russia's State Duma eyes bill to lift crypto bans for citizens, capping retail buys at 300K rubles/year via licensed platforms. Qualified investors unlimited; no domestic payments. Spring 2026 debates ahead. The post Russia’s Crypto Revolution: Retail Access Bill Set For 2026 Debate appeared first on CryptoCoin.News .

Source: cryptocoinnews | Published: Jan 15, 2026Cardano sees a 750% surge in futures flow, ensuring growth potential on a relatively calm market.

Source: utoday | Published: Jan 15, 2026

Bitcoin (BTC) is trading in an ascending price channel, and the market situation indicates that it is approaching a key turning point. Two distinct levels are being monitored by analysts: a move above $105,000 could confirm ongoing momentum, and a decline below $83,000 could signal a systematic shift. Key Bitcoin Price Levels Under Watch EGRAG CRYPTO posted that Bitcoin is compressing near the lower side of its rising trend. According to their breakdown, the channel is still holding, but pressure is building. “A weekly close above $105K confirms strength,” EGRAG noted. If that happens, it could open the way toward the $180K to $210K zone. However, they warned that “a weekly close below $83K would break the channel” and suggested weakness in the current cycle. For now, the price action still respects the existing structure. Bitcoin touched a high of $98,000 on Thursday before dropping slightly on news related to...

Source: cryptopotato | Published: Jan 15, 2026BitcoinWorld CME Group Launches Monumental ADA, LINK, and XLM Futures, Paving New Path for Institutional Crypto CHICAGO, Feb. 5, 2025 – In a landmark move for digital asset markets, CME Group, the world’s leading derivatives marketplace, will launch regulated futures contracts for Cardano (ADA), Chainlink (LINK), and Stellar (XLM) on February 9. This strategic expansion directly responds to growing institutional demand for diversified crypto exposure beyond Bitcoin and Ethereum. Consequently, it marks a significant step toward mainstream financial integration for these three prominent blockchain networks. CME Group Futures Launch: A Deep Dive into the New Offerings The Chicago Mercantile Exchange (CME) will introduce cash-settled futures for ADA, LINK, and XLM. These contracts will settle against the CME CF Cryptocurrency Real-Time Indices. This methodology ensures pricing integrity and aligns with existing Bitcoin and Ether futures. Each contract will represent a specific quantity of the underlying digital asset, providing a standardized, regulated...

Source: bitcoinworld | Published: Jan 15, 2026

We’re thrilled to announce that FUN is available for trading on Kraken! Funding and trading FUN trading is live as of January 15, 2026. To add an asset to your Kraken account, navigate to Funding, select the asset you’re after, and hit ‘Deposit’. Make sure to deposit your tokens into networks supported by Kraken. Deposits made using other networks will be lost. Trade on Kraken Here’s some more information about this asset : Sport.Fun (FUN) Sport.Fun (FUN) is an onchain fantasy sports platform where fans can own, trade, and compete with digital athletes in a skill based game. Unlike traditional fantasy apps, Sport.Fun runs entirely on blockchain, allowing users to own, trade, and compete with digital athlete shares whose value reflects real performance and market demand. The platform’s smart contract architecture powers a self sustaining, skill based economy where every trade contributes to rewards and ecosystem growth. Built for expansion...

Source: krakenblog | Published: Jan 15, 2026Bitmine Immersion Technologies Inc., the largest corporate holder of the cryptocurency Ether and chaired by Fundstrat’s Tom Lee, said it will invest $200 million for a stake in Beast Industries, the private company behind YouTube star Jimmy “MrBeast” Donaldson.

Source: bloomberg_crypto_ | Published: Jan 15, 2026

Luxembourg has emerged as a focal point in Europe’s accelerating shift toward regulated digital finance . As central banks and policymakers explore blockchain-based payment infrastructure, developments in a major financial hub like Luxembourg naturally draw global attention. Recent discussions surrounding Ripple and XRP have intensified interest, raising questions about how far institutional engagement with public blockchain assets may extend. Market commentary circulated by SMQKE has connected these discussions to Ripple’s expanding regulatory presence in Europe. The renewed focus follows Ripple’s preliminary Electronic Money Institution license approval from Luxembourg’s Commission de Surveillance du Secteur Financier, a move that strengthens Ripple’s ability to deliver regulated cross-border payment services across the European Union. What Ripple’s Luxembourg Approval Confirms Ripple’s EMI license allows the company to issue electronic money and provide compliant payment services across EU member states through passporting rights. This approval aligns with Ripple’s broader regulatory strategy, which now includes more than...

Source: timestabloid | Published: Jan 15, 2026Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

Source: cointelegraph | Published: Jan 15, 2026

More on NIP Group NIP Group Inc. (NIPG) Q2 2025 Earnings Call Transcript NIP Group expands bitcoin mining capacity Seeking Alpha’s Quant Rating on NIP Group Historical earnings data for NIP Group Financial information for NIP Group

Source: seekingalpha | Published: Jan 15, 2026After spending much of late 2025 consolidating below six-figure territory, Bitcoin ( BTC ) has started 2026 with renewed momentum. In just two weeks, the world’s largest cryptocurrency has delivered a double-digit gain, pushing back toward the psychologically important $100,000 level and rewarding investors who entered the year with fresh exposure. According to price data as of January 15, 2026, Bitcoin is trading at approximately $96,885, up sharply from $87,412 on January 1, the first trading day of the year. That move represents a year-to-date gain of 10.84%, making Bitcoin one of the strongest major assets so far in 2026. Bitcoin year-to-date (YTD) price chart. Source: Google Finance/Finbold A $1k investment in Bitcoin at the start of 2026 For an investor who allocated $1,000 into Bitcoin at the start of the year, the rally has already translated into meaningful profits. At a January 1 price of roughly $87,412 per coin,...

Source: finbold | Published: Jan 15, 2026

The Chicago Mercantile Exchange lists Cardano, Chainlink, and Stellar derivatives. This aims to cater to both institutional and smaller investors with "Micro" contracts. Continue Reading: Chicago Mercantile Exchange Increases Crypto Options with Lesser-Known Altcoins The post Chicago Mercantile Exchange Increases Crypto Options with Lesser-Known Altcoins appeared first on COINTURK NEWS .

Source: cointurken | Published: Jan 15, 2026Manhattan District Attorney Alvin Bragg has called for more stringent measures to combat criminal activities involving cryptocurrencies. The District Attorney urged the state to criminalize and regulate unlicensed crypto operations, which have now grown to a $51 billion economy. The official stated that the industry has grown and developed due to the presence of loopholes and blind spots in current regulations governing crypto activities. According to Bragg, the blind spot facilitates money laundering activities for drugs, fraud, and gun-related illegal activities. Bragg emphasized that the issue requires urgency and categorized it as a second-term priority, alongside shoplifting and gun control. He demanded that regulators revisit regulations to close down loopholes that allow malicious actors to launder proceeds from criminal activities without facing prosecution. Manhattan DA calls out unregulated crypto ATMs While speaking at New York Law School on Wednesday, Bragg focused on crypto ATMs and unlicensed crypto kiosks. According to...

Source: cryptopolitan | Published: Jan 15, 2026

Dartmouth College, via the Trustees of Dartmouth College, disclosed a new position in BlackRock’s iShares Bitcoin Trust ETF (IBIT), reporting 201,531 shares worth $10,006,014 as of Dec. 31, 2025, according to a Form 13F filed on Jan. 14. The same filing also shows a fresh allocation to the Grayscale Ethereum Mini Trust, a rare double-print of BTC and ETH exposure inside an Ivy League endowment’s public equity book. Dartmouth’s Endowment Adds Bitcoin And Ethereum Crypto market observers flagged the disclosure immediately. MacroScope, an analyst account that tracks institutional positioning, framed the filing as a meaningful signal from the endowment complex: “Very important filing today. In a 13F, Dartmouth College reported owning 201,531 shares of IBIT as of December 31, valued over $10 million. It also reported owning 178,148 shares of Grayscale Ethereum Mini valued at $4.9 million.” The SEC filing provides the precise marks. Dartmouth’s Grayscale Ethereum Mini Trust stake...

Source: bitcoinist | Published: Jan 15, 2026CleanSpark expands Houston Cluster to 900MW, targeting AI firms with clustered capacity and reduced Bitcoin reliance.

Source: ambcrypto | Published: Jan 15, 2026

BitcoinWorld Binance FOGO Perpetual Futures: Strategic Expansion Unlocks New Trading Opportunities Global cryptocurrency exchange Binance has strategically announced the upcoming listing of FOGO perpetual futures contracts, marking a significant expansion of its derivatives offerings in early 2025. This development represents a calculated move within the evolving digital asset landscape, potentially increasing market accessibility and liquidity for the FOGO token ecosystem. The announcement follows extensive market analysis and platform development, positioning Binance to capture growing institutional and retail interest in cryptocurrency derivatives products. Binance FOGO Perpetual Futures: Market Context and Significance Binance’s decision to list FOGO perpetual futures arrives during a period of substantial growth in cryptocurrency derivatives trading volumes. According to recent market data from CryptoCompare, derivatives now account for approximately 65% of total cryptocurrency trading activity globally. The exchange has carefully timed this listing to coincide with increasing institutional adoption of digital asset derivatives. Furthermore, Binance has established a...

Source: bitcoinworld | Published: Jan 15, 2026This content is provided by a sponsor. PRESS RELEASE. Geneva, Switzerland, January 15, 2026 — TRON DAO, the community-governed DAO dedicated to accelerating the decentralization of the internet through blockchain technology and decentralized applications ( dApps), announced today that MetaMask has launched native TRON support across both its mobile and browser extension platforms. Through this

Source: bitcoin.com | Published: Jan 15, 2026

For years, crypto’s most ambitious builders focused on blockchains’ plumbing. But a growing number of projects are now stepping away from the base layer and focusing on payments and neobank-like services.

Source: coindesk | Published: Jan 15, 2026With ETFs and corporate treasuries absorbing more bitcoin than expected, the market is entering a more institutional, lower-volatility era.

Source: coindesk | Published: Jan 15, 2026

TRON DAO said MetaMask has rolled out native support for the TRON network across both its mobile app and browser extension bringing TRON functionality directly into the popular self-custody wallet. The move brings TRON’s infrastructure into MetaMask’s multichain environment allowing users to manage TRON-based assets and interact with TRON dApps without relying on additional wallets or complex bridging workflows. MetaMask is developed by Consensys and is one of the most widely used wallets in the crypto ecosystem, with a growing focus on multichain access beyond Ethereum. Unified Multichain Experience With native TRON support, MetaMask users can now swap assets seamlessly across TRON, EVM-compatible networks, Solana, and Bitcoin from a single interface. The integration allows users to send USDT on TRON, stake TRX, and connect directly to TRON-based decentralized applications, while benefiting from the network’s fast confirmation times and low transaction costs. By embedding TRON directly into MetaMask, the wallet removes...

Source: cryptonews | Published: Jan 15, 2026More on Aether Holdings, Inc. Seeking Alpha’s Quant Rating on Aether Holdings, Inc. Historical earnings data for Aether Holdings, Inc. Financial information for Aether Holdings, Inc.

Source: seekingalpha | Published: Jan 15, 2026

More on CME CME Group's Strengths Are Real, But Already Priced In (Rating Downgrade) The Case For High Highs In CME Group Shares (Rating Upgrade) CME Group: Awaiting Multiples To Come In For This Premium Player CME to adjust precious metals margin requirements amid price volatility CME Group International ADV hits record 8.4M contracts in 2025, up 8% YoY

Source: seekingalpha | Published: Jan 15, 2026BitcoinWorld Federal Reserve Rate Cut: Chicago Fed’s Goolsbee Signals Hopeful Shift for 2025 CHICAGO, March 2025 – Federal Reserve Bank of Chicago President Austan Goolsbee has set the financial world abuzz by publicly anticipating an interest rate cut within the year. This significant statement provides a crucial signal about the potential direction of U.S. monetary policy. However, Goolsbee simultaneously emphasized a data-dependent approach, underscoring the central bank’s cautious stance. His comments arrive at a critical juncture for markets, businesses, and consumers nationwide. Federal Reserve Rate Cut Expectations Gain a Vocal Advocate Austan Goolsbee, a voting member of the Federal Open Market Committee (FOMC) in 2025, articulated his outlook during a recent economic forum. He stated that current inflation trends and labor market conditions could justify a policy easing later this year. Consequently, investors immediately adjusted their forecasts for the timing of the first rate reduction. Goolsbee’s perspective carries substantial weight...

Source: bitcoinworld | Published: Jan 15, 2026

More on DDC Enterprise Seeking Alpha’s Quant Rating on DDC Enterprise Historical earnings data for DDC Enterprise Financial information for DDC Enterprise

Source: seekingalpha | Published: Jan 15, 2026The UK is weighing an Australia‑style ban on social media for under‑16s, as regulators ramp up enforcement of the Online Safety Act.

Source: cointelegraph | Published: Jan 15, 2026

ETF flows, treasury stocks, mining fees, scaling trade-offs and regulation now explain Bitcoin’s market shifts better than price alone.

Source: cointelegraph | Published: Jan 15, 2026Key takeaways : Binance coin price prediction for 2026 indicates that the coin’s price could reach a maximum price of $1,573.34. The Binance coin price prediction for 2028 projects a maximum price of $3,321.49 and a minimum price of $2,797.05. By 2032, BNB’s price could surge to $6,817.80 with broader acceptance in mainstream finance. After notable changes in its executive team, Binance has shown resilience and prospects for recovery. The departure of Changpeng Zhao, Binance’s CEO, who was also embroiled in legal challenges, initially caused a decline in the value of Binance coin (BNB). Despite this initial setback, the cryptocurrency has shown a positive trend. In September 2020, Binance introduced BNB Smart Chain, which was initially designed for trading and transferring tokens and runs parallel to Binance Chain and supports smart contracts and decentralized applications (dApps). What’s next for BNB in the remainder of 2026 and beyond? What can be...

Source: cryptopolitan | Published: Jan 15, 2026

The crypto market structure bill in the US Senate has been delayed amid disagreements among lawmakers and influential cryptocurrency companies.

Source: cointelegraph | Published: Jan 15, 2026

Two prominent technology companies have been cut from South Korea’s government-backed effort to build an artificial intelligence system without depending on American or Chinese technology. The Ministry of Science and ICT revealed the decision today after completing initial reviews of the national program. Naver Cloud and NCSoft are no longer in the race. The other three organizations that will progress are Upstage, SK Telecom, and LG AI Research. The government organized this competition to create what officials call a “ sovereign AI ” basic paradigm. The goal is to develop technology that South Korea can handle on its own. Scoring criteria for the evaluation proces s Th e two government agencies in charge of the assessment process were the Telecommunications Technology Association and the National IT Industry Promotion Agency. The teams were assessed using three criteria. 40 points were awarded for benchmark testing. This section evaluated the AI systems’ ability...

Source: cryptopolitan | Published: Jan 15, 2026Societe Generale-Forge said its EUR CoinVertible stablecoin is the first MiCA-compliant digital asset that is “natively compatible” with SWIFT’s interoperability capabilities.

Source: cointelegraph | Published: Jan 15, 2026

The National Collegiate Athletic Association has asked the US Commodity Futures Trading Commission to immediately suspend college sports prediction markets, warning that the fast-growing sector is exposing student-athletes to heightened risks and undermining the integrity of college competition. The request targets an estimated $320 million in active college sports markets, a figure that reflects how quickly prediction platforms have expanded into territory long dominated by regulated sportsbooks. As Prediction Markets Grow, NCAA Pushes for Safeguards In a letter dated January 14, 2026, NCAA President Charlie Baker urged CFTC Chairman Michael Selig to halt collegiate sports prediction trading until stronger safeguards are put in place. Source: NCAA Baker argued that although prediction markets are often framed as financial products, many now function in practice like sports wagering. NCAA noted that platforms are offering moneyline, spread, and total markets on college games that closely mirror traditional betting, while operating under a lighter...

Source: cryptonews | Published: Jan 15, 2026BitcoinWorld BNB Chain Token Burn Executes Monumental $1.3 Billion Deflation in 34th Quarterly Event In a significant deflationary move, BNB Chain has executed its 34th consecutive quarterly token burn, permanently removing a staggering 1.37 million BNB tokens, valued at approximately $1.277 billion, from circulation. This event, completed for the first quarter of the year, underscores the blockchain’s long-standing commitment to its pre-programmed tokenomics model. Consequently, the action directly reduces the total supply of BNB, a core mechanism designed to create scarcity and long-term value alignment for the ecosystem. The scale of this burn, one of the largest in the network’s history, immediately draws attention from investors and analysts globally, prompting a fresh examination of supply-side economics in major blockchain networks. Understanding the BNB Chain Token Burn Mechanism The BNB Chain token burn is not a spontaneous decision but a fundamental, automated component of its economic design. Originally, Binance Coin (BNB)...

Source: bitcoinworld | Published: Jan 15, 2026

Bitcoin climbed above $95,000 amid renewed risk appetite, strong ETF inflows, and stable macro conditions, while ethereum staking reached a fresh all-time high near 30% of supply. Broader market sentiment is turning bullish, though key data releases and geopolitical factors still pose risks. Crypto Strengthens on Macro Optimism Despite Geopolitical Risk Global markets turned broadly

Source: bitcoin.com | Published: Jan 15, 2026High-ranking Shiba Inu executive issued a major reminder about the key "SHIB Owes You" motto.

Source: utoday | Published: Jan 15, 2026

BitcoinWorld JustLend DAO’s Strategic $21M JST Buyback: A Bold Move for DeFi Confidence in 2025 In a decisive move that has captured the attention of the decentralized finance (DeFi) sector, the JustLend DAO governance community has executed a major token repurchase. The protocol has successfully bought back 525 million JST tokens, representing a substantial $21 million investment into its own ecosystem. This strategic action, announced on March 15, 2025, signals a pivotal moment for one of the TRON network’s leading liquidity protocols and offers critical insights into evolving DeFi treasury management strategies. Analyzing the JustLend DAO JST Buyback Mechanics The core transaction involves the protocol’s treasury utilizing accumulated fees and revenue to purchase JST tokens directly from the open market. Consequently, this action reduces the circulating supply of the governance and utility token. Typically, such buyback programs aim to return value to long-term token holders and stabilize the asset’s price...

Source: bitcoinworld | Published: Jan 15, 2026Galaxy Digital has completed its first tokenized CLO, using blockchain infrastructure to bring private credit and crypto-backed loans onchain.

Source: cointelegraph | Published: Jan 15, 2026

Robinhood announced the listing of Lighter (LIT), boosting its market presence. LIT experienced a 5% rise following the news of its listing. Continue Reading: Robinhood Adds New Altcoin to Its Platform The post Robinhood Adds New Altcoin to Its Platform appeared first on COINTURK NEWS .

Source: cointurken | Published: Jan 15, 2026

Recent technical observations shared by crypto enthusiast Bird have placed Bitcoin at the center of short-term market expectations, with implications extending beyond BTC. According to the analysis, Bitcoin is trading within a consolidation range that has held for nearly two months, with current price action sitting less than two percent below the upper boundary of that structure. The attached chart highlights a prolonged period of compression, followed by price behavior that suggests Bitcoin is positioning for a directional move. Bird’s assessment emphasizes that this range has acted as a stabilizing phase after prior volatility. The tightening structure, combined with recent upward pressure, is presented as a setup that typically precedes expansion. The chart illustrates Bitcoin holding above rising diagonal support while repeatedly testing resistance at the $93,580 price point. Bitcoin is less than 2% away from breaking out of this nearly two month range. Once this breakout confirms (likely this...

Source: timestabloid | Published: Jan 15, 2026CoinGecko’s CEO, Bobby Ong, acknowledged on Thursday that the company is exploring “ strategic opportunities ” following media reports suggesting the firm is pursuing acquisition offers valued at approximately $500 million. “After close to 12 years of developing CoinGecko as a self-funded enterprise, a common question I encounter concerns our future direction. What I can reveal today is that CoinGecko is expanding and maintaining profitability, while witnessing heightened institutional interest as traditional finance sectors increasingly adopt cryptocurrency,” Ong stated on LinkedIn . Media reports, attributed to sources with knowledge of the situation, revealed that CoinGecko is exploring a possible sale with an estimated valuation of $500 million. JUST IN: According to CoinDesk, crypto market data platform @coingecko is exploring a potential sale at a valuation of around $500M and has hired investment bank Moelis to advise on the process. pic.twitter.com/D4IkyJ1jw0 — SolanaFloor (@SolanaFloor) January 13, 2026 Moelis Tapped as CoinGecko...

Source: cryptonews | Published: Jan 15, 2026

The Mantra project announced the end of its token migration period. Around 7% of the OM token supply remained locked in the form of ERC-20 tokens. The Mantra project is making the last call for migrating its OM tokens from Ethereum to its native chain. The team announced the last day of the migration period, leaving the remaining tokens locked on Ethereum. MANTRA enters a new era. Today is officially the last day to migrate your ERC20 OM to MANTRA mainnet. — MANTRA | Tokenizing RWAs (@MANTRA_Chain) January 15, 2026 The migration may have decreased the supply of OM, as around 7% of the supply remains unmigrated and may remain stuck on the old chain. The token swap was facilitated by Kraken, which was one of the first holders of OM on the new native main net. OM is seen as a risky asset, with slim chances of recovery, as...

Source: cryptopolitan | Published: Jan 15, 2026BitcoinWorld Fogo Mainnet Launch Ignites a New Era for High-Speed SVM Layer 1 Blockchains In a significant development for the blockchain scalability race, the SVM-based Layer 1 chain Fogo has officially launched its public mainnet, introducing a network that claims to redefine transaction speed benchmarks for decentralized ecosystems. This launch, reported by The Block, positions Fogo not just as another entrant but as a potential paradigm shifter with its audacious performance metrics and a clear path for community token distribution. The move arrives at a critical juncture where demand for faster, more efficient Layer 1 solutions continues to surge globally. Fogo Mainnet Ushers in Unprecedented Speed Claims Fogo’s core technical proposition centers on raw speed and finality. The network officially boasts a block generation time of just 40 milliseconds. For context, this metric represents the interval between the creation of new blocks on the chain, directly influencing transaction confirmation times...

Source: bitcoinworld | Published: Jan 15, 2026

Bitcoin’s early-2026 bounce has pushed back into a familiar problem area: a dense pocket of overhead supply that Glassnode says has repeatedly capped rallies since November. In its latest Week On-chain report, the analytics firm frames the move above $96,000 as constructive on the surface, but still largely dependent on derivatives positioning and liquidity conditions rather than persistent spot accumulation. Glassnode’s central argument is that Bitcoin has rallied straight into a historically significant band of long-term holder (LTH) cost basis, built during April to July 2025 and associated with sustained distribution near cycle highs. The report describes a “dense cluster” spanning roughly $93K to $110K, with rebounds since November repeatedly stalling near the lower boundary. “This region has consistently acted as a transition barrier, separating corrective phases from durable bull regimes,” Glassnode wrote. “With price once again pressing into this overhead supply, the market now faces a familiar test of...

Source: newsbtc | Published: Jan 15, 2026As Trump heads to Davos, debates over AI and crypto regulation intensify. Armstrong’s refusal to back a crypto bill signals a shift toward infrastructure level policy.

Source: forbes | Published: Jan 15, 2026

XRP has bounced nicely with the rest of the market, but it’s still trading as a laggard rather than a leader. The latest push was strong enough to squeeze shorts and reset sentiment from extreme fear to neutral, yet the price is stalling right where you would expect sellers to defend: higher-timeframe resistance and key moving averages. XRPPrice Analysis: The USD Chart On the daily chart, XRPUSDT has pushed into the $2.00 resistance block and is struggling to hold above it after a sharp bounce off the $1.80 demand zone. The asset was recently rejected by the 100-day moving average, with the 200-day MA still sitting higher as an additional dynamic resistance, so the medium-term structure is still bearish. The RSI also briefly tagged the overbought region and is now curling down, which fits the idea of a relief rally hitting a ceiling rather than a fresh bullish trend. Yet,...

Source: cryptopotato | Published: Jan 15, 2026BitcoinWorld Robinhood Spot LIT Listing: A Strategic Leap for Mainstream Crypto Adoption In a significant move for retail cryptocurrency access, the trading platform Robinhood announced on April 2, 2025, that it has officially listed spot LIT for trading. This decision marks a pivotal expansion of the platform’s digital asset offerings, directly providing millions of users with exposure to the LIT network’s native token. Consequently, the listing represents a continued blurring of lines between traditional fintech services and the broader digital asset ecosystem. Analysts immediately viewed the announcement as a validation of LIT’s growing infrastructure and a strategic play by Robinhood to capture a broader segment of the crypto-curious investor base. Robinhood Spot LIT Listing: Context and Market Impact The Robinhood spot LIT listing arrives during a period of maturation for both the company and the cryptocurrency sector. Historically, Robinhood Crypto has carefully curated its asset selection, focusing on high-liquidity, large-market-cap...

Source: bitcoinworld | Published: Jan 15, 2026